Finance Fair

Looking for finance to grow your social enterprise? Meet with a range of finance providers, from equity to loans, social impact bonds to crowdfunding. Choose up to 3 funders to have a 10 minutes conversation and pitch about your social entrerprise.

Meet the funders:

Indiegogo is a global crowdfunding platform that democratizes the way people raise funds for any project such as creative, technology, entrepreneurial, or cause-related. The platform enables individuals and startups to generate pre-sales and collect feedback from early adopters before they manufacture their products. Since its inception in 2008, Indiegogo has been offering related advice to individuals and startups that seek it and advising corporations on how to staff a team to create and manage a campaign effectively.

Founded in 2005, Big Issue Invest extends The Big Issue’s mission to dismantle poverty through creating opportunity by financing the growth of sustainable social enterprises. Big Issue Invest offers social enterprises, charities and profit-with-purpose businesses, loans and investment from £20,000 to £3 million. Since 2005, we have invested more than £30 million in approximately 300 social enterprises and charities across the UK. Our goal is to continue supporting organisations that are seeking to dismantle poverty through creating opportunity for people and communities across the UK. The capital raised by Big Issue Invest is mainly from private sources and not from sales of the magazine.

CAF Venturesome provides affordable financial support to charities and social enterprises registered in the UK in the form of unsecured repayable loans ranging from £25-350k:

- Unsecured Loans – for up to five years

- Standby Facility – similar to overdraft, a pot of money that is put aside for your organisation that can be accessed if and when it is required

- Other less common social investment products, including Social Impact Bonds and revenue participating agreements

Trust For London is a charitable organisation that exists to reduce poverty and inequality in London. We do this by funding the voluntary and community sector and others, as well as by using our own expertise and knowledge to support work that tackles poverty and its root causes. Each year make around 130 grants totalling around £7 million. Alongside this, we are also able to make social investments and currently have deployed nearly £9 million in loans and equity for this purpose.

ClearlySo is Europe’s leading impact investment bank, working exclusively with businesses and funds delivering positive social, ethical, and/or environmental impact as well as financial return.

Originally founded in 2008, ClearlySo has helped more than 100 clients raise more than £115 million in impact investment from its extensive network of high-net-worth individual and institutional investors.

As a regulated financial intermediary, we act as an appointed representative to our wholly-owned subsidiary Catalyst Fund Management and Research Ltd., which is authorised and regulated by the Financial Conduct Authority (FCA).

At ClearlySo, we envision a world where the financial system is a powerful force for good and the impacts of businesses are considered in all investment decisions. We believe that introducing impact as the third dimension into investment decisions is changing the financial system into a force for good, and that businesses can be both high-return and high-impact.

This means finding values-aligned investors for businesses, to ensure that their impact grows as their business thrives. As one of the only intermediaries focused entirely on impact investment, we have unparalleled access to institutional investors, high-net-worth individuals and government. Our team is skilled in financial markets, yet uniquely capable of balancing financial considerations with those of values-driven shareholders and stakeholders, such as Trade Unions, impact investors, ethical funds, Church groups and others. We also manage the UK’s largest impact-focused angel investing network, Clearly Social Angels.

Our team of experts and our investor networks make us stand out – while our core vision ensures that we are best-placed to support businesses looking to grow their impact in line with their revenues or profits.

NatWest Social & Community Capital is an independent charity, supported by NatWest, which provides loans of between £30,000 and £750,000 along with business support to viable social enterprises who make a positive impact to their community but who are unable to access mainstream funding. We will fund charities and enterprises with a social legal structure, who are financially viable, demonstrating impact within the communities in which they operate, who are investment ready but who have been declined by a mainstream bank. There is no deadline to apply, we operate across sectors and funding is open throughout the year.

New funders to be advertised soon!

We are also running workshops to get you ready for your pitch! If you are interested, access our Eventbrite page and subscribe. Please, be aware we have limited availability. Applicants will be allocated on a first come first served basis.

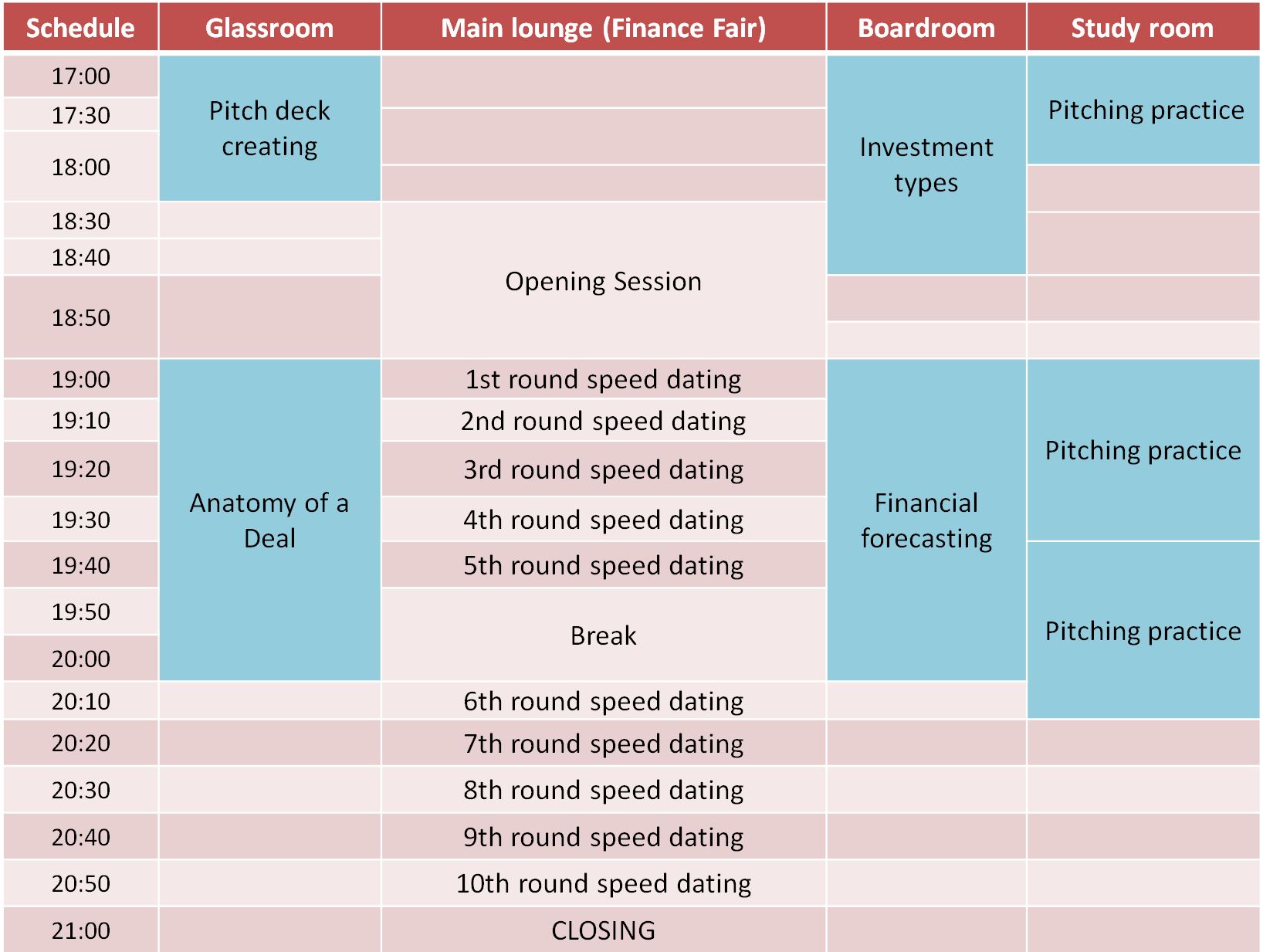

Detailed Schedule

See other Events